What's happening in growth stage VC?

Follow me @samirkaji for my weekly thoughts on venture capital

TL:DR Summary

We are experiencing a reversion to the mean as the market downturn is acting to offset the late 2020-2021 spike in asset prices. We anticipate new deal data to validate this observation starting with Q2 (and certainly Q3) numbers.

Private company mark downs will take quarters (or years), not months to fully be represented.

The market reset provides a return to a rational environment where underwriting of deals has shifted away from a “growth at all costs” mentality, and inclined toward fundamental metrics such as margins, capital efficiency, and the current public market comps.

2020/2021 vintage year late-stage funds that had accelerated deployment timelines are at the highest risk of underperformance.

Large hedge/crossover funds have generally vacated the late-stage private markets, instead opting for earlier stage or public market investing. It’s uncertain whether this is simply transitory.

Deal velocity has slowed down dramatically, with a particular slowdown in $50MM-$100MM+ ‘mega rounds’ as bid/ask spreads between companies and investors remains large.

Growth stage investing will return to being a dependable area of investment marked by lower risk and shorter times to liquidity. However, generating outsized performance will require careful manager and deal selection as the extended bull market era where “everyone wins” is unlikely to be seen anytime soon.

In our last post, we outlined the changing conditions in the market and the potential implications for the venture capital market. Since that post, inflation accelerated to 8.6%, and the Fed raised interest rates by 0.75%, with another similar raise expected again this month (July).

Accompanied by exogenous geopolitical tensions, uncertainty, and anxiety around key market indicators such as inflation, rising rates, corporate earnings, and unemployment, a technical recession seems more likely than previously considered. These fears were reflected in the US public equity markets, as the S&P finished down 20.6%, the most significant first half decrease since 1970, while the NASDAQ ended the first half down 30%.

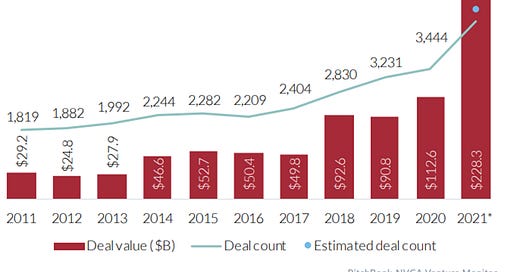

In recent months, we have spent considerable time studying the venture markets to extract tangible views to help investors consider their investment approach to investing in venture capital. This post will focus on the late-stage private tech market, which became the hottest part of the market in 2020-2021. The chart below (using Pitchbook data) illustrates private late-stage activity compared to prior years.

As we've said in prior writings, 2021 was one of the most anomalous years in modern US market history and in our opinion the 2nd half of 2021 represented the frothiest time for technology investing aside from 97-2000.

Driven by federal stimulus and aggressive Fed action, trillions of dollars of liquidity flooded the market and took asset prices to historic levels. During this time, investors happily suspended disbelief to engage in FOMO (Fear of Missing Out) driven speculative behavior (typically in higher-growth assets such as crypto and tech stocks), albeit through daily battles with cognitive dissonance.

Before we cover our current observations on the late-stage private markets, let's first draw some perspective. While the public markets have experienced a massive pullback this year, it's important to remember that the net effect of the market movement is simply a reversion to the mean. The average long-term returns of the US public equity markets are 8-10%. The S&P and the QQQ index are still 10%+ per annum from the pre-pandemic highs.

As investors, we often, (and understandably), place more weight on losses over gains, and many taking the largest losses this year were also the biggest beneficiaries of the cycle in 2021.

Late-Stage observations:

- Write-downs in venture capital funds are starting to occur, but primarily in venture funds with significant public market positions (note that venture funds often hold public positions due to lock-up rules and, in some instances, fund managers may have policies on the timing of distribution of public shares after lock-up).

- Historically, the drop in prior vintage marks during downturns takes many quarters (or years) to fully materialize. As an example, many companies that raised large rounds in 2021 have 2-4 years of cash runway remaining, giving them ample time to potentially grow wholly or partially into the valuations provided.

- Even if we see a widespread 30-50% drop in valuations of holdings, historic venture-style returns (20%+ net IRR) may still be provided by the top quartile funds of the past vintages. That said, many late-stage funds in 2020-2021 may be irreparable, particularly for fund managers who deployed quickly and loosely into an expensive, risk-laden time period (and do not have any significant winners to offset the effects of mass repricing of assets).

- Private markets take cues from the public markets, moving from late-stage to early stage. In 2020-2021, the multiples for publicly traded companies exploded as investors valued “growth at all costs” over profitability or unit economics. Similarly, private market investors poured capital into high-growth mature companies at multiples believed to be the "new normal" of how companies would be received in the public markets. Today, the pendulum has swung entirely back to historic averages on multiples in the public markets, and the private markets have taken the same cue on newly priced deals. A recent example is the buy-now-pay-later start-up Klarna which is reportedly preparing to raise capital at a $6.5B valuation ($1.6B in reported annual revenues) –, a more than 85% discount to the last valuation of $45B.

- Large crossover players have vacated the space. In recent months prominent players such as Tiger Global and D1 have moved away from late-stage private investing, instead opting for early-stage or public market investing.

- Growth investing has slowed to a crawl. We expect the trajectory of late-stage investing to continue to slow through 2022 and into 2023 as:

1) Companies that raised in 2020/2021 at heightened valuations are not testing the capital markets and opting instead to cut cash burn to extend runway or receive smaller cash infusions from existing investors through notes.

2) The bid/ask spread is still wide for investors and companies to meet on mutually acceptable valuations. Both parties are still calibrating to the new reality, and late-stage CEOs are unlikely to entertain down or highly structured rounds until they need to raise capital for viability. This may not occur at scale until early-mid 2023.

3) Fund managers are allocating more time and resources to existing portfolio companies (note that this is true for all stages).

- Deal terms have not shifted materially as most of the new deals completed in Q2 appear to have standard terms, including 1x liquidation preferences. Again, this may change moving into 2023, when more companies will be forced to raise non-insider rounds. At any rate, the market is significantly more investor friendly than anytime in the last decade (outside of perhaps March-April 2020).

For investors, this is an anxious and uncertain time. It is also a time when significant opportunities will likely be available across asset categories, with VC being no exception. In the late-stage VC market, we believe that much of the opportunity will return in the latter part of this year into 2023. History has illustrated that great companies form and grow regardless of market cycles.

However, in the future, the successful distinction of underlying manager and company quality will be even more critical to acceptable investment performance. As Howard Marks has said (in reference to bull markets), “the business is full of people who got famous for being right once in a row”. When market cycles rotate to the present is when we see the highest degree of separation in manager quality.