TLDR:

Venture managers are changing their behavior with respect to new deal pacing and valuations. Although pacing has slowed, the market has not fully adjusted to the new market as investors and entrepreneurs are still evaluating how to participate in this new market economy.

The period defined by 2020-2021 is highly anomalous, and can not be used as a proxy or anchoring point for private market valuations, exit activity, or returns.

Fundraising cycles will slow and deployment periods will revert back to 2.5-3 year cycles as managers deploy capital less aggressively and adjust to the new reality of a tougher fundraising climate (from limited partners).

Firms that are not well positioned within the venture capital segment they operate in will struggle to raise funds and we may see a reduction in the number of firms actively deploying capital.

Innovation is secular and will not slow. Instead, layoffs often create a robust environment for new company formation and consolidation of top talent. Innovation tends to thrive in periods of disruption.

Growth valuations have corrected and will continue to ripple down to earlier stages, portfolio markdowns for 2020 & 2021 vintages will happen but may have some lag.

Venture will continue to be a top performing asset class, however return dispersion will increase relative to the top and bottom quartiles of performance. Additionally, with the market reset, we are optimistic that current and vintage years in the near future will benefit greatly from the reset.

The last few weeks formally cemented the conclusion of the thirteen year bull market we all experienced (which apexed with the most recent two-year cycle of extreme price inflation stemming from central bank policy). With rising interest rates and the signaled reduction of the central bank balance sheet from the current $9T, the market has dropped suddenly and precipitously as the S&P and the tech-heavy NASDAQ are down 18% and 30% respectively since the beginning of the year.

From Craft Ventures' recent "operating in a downturn" presentation, the chart below illustrates how steep the drop has been for previously high-flying growth tech stocks from their 52 week highs.

The chart below (also from the Craft presentation) also shows the anomalous high revenue multiples for growth stocks between January 2019 and December 2021. These multiples have contracted dramatically in the first half of 2022 and are back to the levels seen in 2018. High-growth companies are no longer priced at large premium revenue multiples relative to their slower growing peers, and we can see how the Fed's aggressive infusion of liquidity into the system resulted in a highly outlier period of asset prices in technology startups.

As market sentiment has now fully rotated toward a recessionary outlook, investors have fled from growth and speculative assets. The steep drop in stock prices also relates to a return to fundamentals with higher discount rates applied toward equities (which affect cash flow negative companies more significantly).

While it's uncertain how the markets will play out over the next 12-18 months, there appears to be elements from the late 70's/early 80's (monetary tightening & stagflation), the late 90's (tech overexuberance), and the global financial crisis of 2008-09 (systemic financial risk). Regardless, the decade-long era of easy capital is likely over and we all must adjust.

So, what does this mean for venture capital?

First, here are a few quick points of what we are seeing:

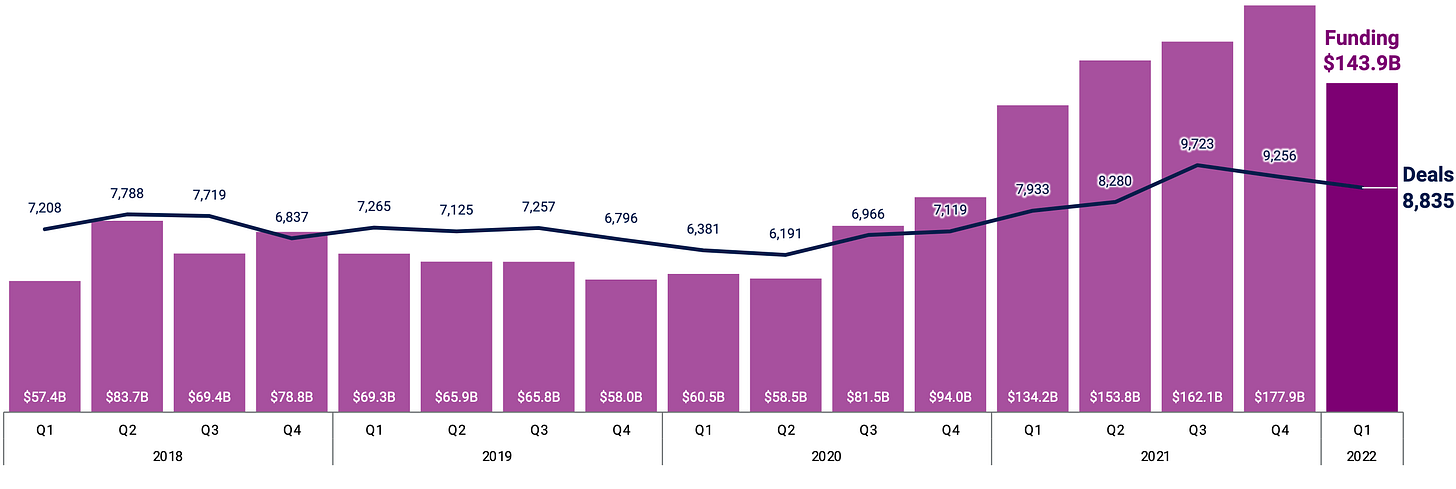

Deal pacing has slowed. According to CB Insights, VC funding in Q1 dropped 20% quarter over quarter (see chart below). Despite record amounts of dry powder, we anticipate the Q2 numbers to show an even more significant drop as fund managers 1) face more headwinds with existing portfolios to which they must dedicate more time to 2) continue to evaluate quickly changing market conditions to inform investment strategy 3) pull back on the velocity of the $100MM+ rounds we saw in record numbers in 2021 (Tiger has publicly pulled back) and 4) adapt to the reality that raising capital from institutions may become more challenging (more on this below).

According to Carta data (chart below), valuations have also taken a hit. As expected, deals in the growth stage have seen the most significant dip in valuations as growth stage multiples most closely mirror the public equities market. The chart also shows softening in earlier stage valuations. This finding is not entirely unexpected, but historically we have seen a longer lag. Public markets affect the entire chain of venture capital valuations, starting with the growth stage and ultimately moving into the early stages as investors look to adapt to the changing pricing environment driven by downstream capital providers. We expect continued downward pressure on valuations throughout 2022 and into 2023.

Mark-downs of prior vintages are starting to occur but will take some time given valuation and reporting lags. We anticipate that the vintage years of 2018-2021 will likely have the most vulnerability as entry prices, quick deployment periods, and the additional risk that periods of overcapitalization bring to the venture industry. To expand on the latter point as more limited partner capital floods the market, funds get larger → funding rounds increase in size as do valuations → cash burn increases → companies with high burn without strong fundamentals face existential threats when capital markets retreat.

Our thoughts going forward:

While market conditions are multi-variate and unpredictable, we do not envision a rapid bounce-back as we saw in Q2 2020 (decidedly driven by fiscal and monetary policy). Our estimate is that the markets remain uneven and bearish well into 2023.

But…This reset is healthy. While we will see the downside through employee layoffs, failed high-profile startups, and reduced returns of prior funds, we believe the medium to long-term outlook of venture capital investing is improved as valuations and investment pacing return to more sustainable levels.

Unicorns? While it's inevitable that many unicorns will ultimately fall out of unicorn status or implode completely, we still expect to see new unicorns being minted. However, unlike the last few years, receiving a $1B+ valuation will be reserved for companies that have exceptional growth and unit economics. If we apply today's public multiples to privates, accounting for the premium private markets receive, a startup will need $50MM-$100MM in annualized revenue to approach unicorn status. In 2021, we saw companies achieve unicorn status with as little as $10MM in revenue (100X multiple!). There will be some exceptions (i.e. bio and other forms of deeptech).

Fundraising cycles will slow. We believe that fundraising cycles for most fund managers will lengthen from the 1.5-2 years between funds to 2-3 years as deployment cycles elongate. The length of time for a successful fundraise may also lengthen for the majority of fund managers as institutional investors are confronted with the dreaded “denominator effect”. The retreat of institutional capital due to asset allocation issues historically has had a significant effect on venture capital supply (and a reduction in VC supply typically results in a reduction in deployment pace and valuations).

Innovation will continue unabated. As with prior market downturns, we do not believe there is much correlation between economic cycles and the formation of category-defining companies. Companies such as Uber, Airbnb, Square, WhatsApp, MailChimp, and Adobe were all founded during recessionary periods. Tomorrow’s category defining companies will continue to launch and operate in the innovation space and have venture capital as their primary backing.

Venture capital will continue to provide alpha, but the path will be more difficult. Over the last decade, a high percentage of venture capital funds performed well on an absolute basis relative to other asset categories. While venture capital should continue to do well across cycles, the divide between the "have" and "have-nots" will present more brightly as we advance. Additionally, as we have seen in past cycles, zombie firms will emerge (firms with active funds but no longer are making new investments). Firms with distinct competitive advantages within the segment of VC they operate in will offer investors significant upside. We believe this presentation does a great job of illustrating stable points within the venture capital ecosystem where fund managers can succeed to the extent they have tangible comparative advantages with those points. Finding and securing access to these managers will be key to generating acceptable performance (venture fund investors typically seek annual returns that are 5-10% above historical S&P yields of 8-10%).

Growth and late stage investing will become attractive again. With the abrupt shifting of the public markets, private growth multiples have taken a similar turn. However many companies are opting not to test the equity waters right now, and instead are taking measures to reduce cash burn (or leverage cheaper options such as debt) in order to weather the storm. As a result, the number of growth opportunities has decreased for investors in the first half of the year. However, many companies in the Series C/D/E stages will ultimately need to access capital in 2022-2023, and an uneven market environment will benefit growth stage investors.

Hope you enjoyed the summary!

I wonder if you took the weighted average IRR for all VC funds say 10 years old if the return justifies venture investing compared to returns in the S&P 500 considering the risk and lack of liquidity.

The one and only piece of content that summarised all. Thanks so much for this work and sharing it 🙏