Why emerging managers have become a staple of LP portfolios

Follow me @samirkaji for my thoughts on the venture market, with a focus on the continued evolution of the VC landscape.

A critical characteristic of healthy asset categories is the flow of new entrants. New entrants bring new ideas, models, and necessary competition.

In the mid-2000s, advances in technology infrastructure made it possible for software development to happen inexpensively, and software companies started to address problems across nearly all industry verticals. During that period, we saw the formation of Y Combinator (2005), a new model of 'startup accelerator' to further fuel technology company formation and growth.

The combination of new startup accelerators and reduced overhead costs (companies no longer needed to buy servers) brought the explosion of new fund entrants and the accompanying institutionalization of the seed stage market. Instead of single monolithic investment models, we saw new managers with investment models focused on stages, sectors, and niches. Most emerging managers remain seed stage-focused funds, and today we estimate that the number of seed firms in the US exceeds 2,000.

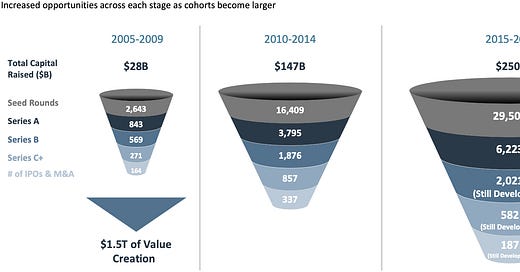

Not surprisingly, the number of seed rounds in 2015-2019 saw a 10x+ increase compared to the five-year period a decade earlier.

Source: Pitchbook as of 10/10/2021. Note: Excludes China-based companies.

The first generation of emerging manager formation was approximately fifteen years ago when firms such as Floodgate, Uncork (fka SoftTech), Baseline, and First Round Capital all formed. These firms have thrived and become top-tier managers that are understandably significantly access constrained and highly desired by LPs.

Defining an Emerging Manager

There isn't a clear consensus on the definition of that term, but broadly speaking, we think of emerging as a firm early in its development, quantified by tenure or by assets under management. A rule of thumb could be a firm on Fund I-III (sometimes IV).

As we look at the emerging manager universe today, we think there are five general emerging manager archetypes:

An investor at an established firm that decides to spin out to create a new firm

An operating professional who was an early or meaningful contributor to a successful technology company.

An angel investor who is looking to formalize their investing and raises third-party capital

Someone with a very specialized skill set or network that can be applied in a specific way to enable startups to grow and scale

A combination of some of these categories (which tends to be the most common)

As mentioned earlier in this post, most emerging managers are smaller and focused on seed and early-stage investing. While this remains true from a pure numbers (of firms) standpoint, we now see emerging managers of all sizes and scales. Examples include:

Katie Haun's (ex- Andreessen Horowitz) new firm raised $1.5B in just 82 days in 2021.

Mary Meeker's team at Kleiner Perkins spun out to form later-stage firm BOND Capital, with $1.3bn in capital for their first independent Fund.

Wes Chan and Pegah Ebrahimi recently closed a well-oversubscribed $450MM for their new firm, FPV.

From a performance standpoint, emerging managers have also fared well. We believe there are many attributable factors, including:

In the earliest days, firms are more likely to be focused with little drift away from their core competency.

The reduced complexity of managing a firm helps managers focus more time on investments.

Better alignment with investors, as the manager is highly motivated to succeed and ultimately 'emerge.'

Because emerging managers tend to be smaller, the opportunity to generate outsized outcomes from a single position is significantly greater.

Earlier managers tend to have a decision making focus on return maximization versus loss aversion

The chart below demonstrates the performance of emerging managers relative to established managers.

Given these return dynamics, one would expect emerging managers to make up a significant percentage of capital raised in the venture market. However, according to the NVCA and Pitchbook, less than 30% of total venture capital allocations (on average) have been allocated to emerging managers over the last decade. Much of this can be attributed to institutional LPs being unwilling or unable to invest in fledgling firms (often, emerging managers are too small for a typical endowment to meet their allocation sizing requirements).

The challenge and opportunity

Every manager in the market today was emerging at one point, and behemoths like a16z just formed thirteen years ago.

Getting into a fund with a firm early in life is often critical to reserve a seat at the table in later funds. Firms such as Forerunner Ventures, Craft Ventures, IA Ventures, Ribbit Capital, Initialized Capital, and Felicis Ventures are some of the most sought-after funds in the world today and are incredibly access constrained given the breakout performance they've experienced.

While it's clear that emerging managers provide an enormous opportunity for outsized returns, a higher probability of co-invest, and the chance to get on the ground floor, many LPs struggle with this part of the market, given the hundreds of new managers that have formed each year over the last half-decade. Emerging Managers have a higher degree of performance volatility, so discovering and picking the right firms is paramount in achieving the outsized performance that is possible.

Picking is also tricky as many emerging managers have limited or no identifiable track records. Over the past 12 years, we've worked with over 1,000 emerging managers and have spent significant time creating an investment rubric for assessing emerging managers as we consistently saw LPs invest in emerging managers based solely on feel, first-degree network introductions (thus limiting the supply pool), and not having enough diversification across managers.

A strong venture capital portfolio typically has a mix of established managers and emerging managers. The latter provides higher potential of extreme outlier performance while allowing the LP to build a future pipeline of established managers as many emerging managers will break out and become household names.

While we acknowledge that emerging manager investing is difficult as each Fund comes with more risk, and finding the right ones can be akin to finding a needle in a haystack, the payoffs can justify the effort.