When I co-founded Allocate in 2021, it was based on a 20 year observation that 1) Companies are staying private longer 2) Private markets started to become as important as the public market for investors (There are reportedly 108K software companies today but only 3% are public) and 3) Investors and GPs are still relying on outdated tools to deploy capital and to raise capital.

So despite the growth of the private markets, the increased fragmentation on both sides of the ecosystem (new manager entrants and the growth of high net investor interest) have created a system wrought with inefficiency and opacity.

Private market assets under management (AUM) have surged past $13 trillion, with projections to exceed $25 trillion by the decade's end. This is not suprising given the protracted time companies stay private (for tech companies <4 years to 9 years+), the reduction of publicly traded companies, and historical return and diversification benefits of private markets.

However, the current system does not support efficiency.

Finding, performing due diligence, and accessing the right fund managers has become an exhaustive, time-consuming endeavor for LPs, amplified by the market's lack of transparency.

Beyond this, managing a private investment portfolio effectively is a significant challenge. Building a well-constructed portfolio, tracking investments and gaining key insights, and ensuring that new opportunities align with an investor’s evolving goals is nearly impossible without a structured, data-driven approach.

For most investors, this results in private market investing being more ad-hoc than programmatic, which often leads to performance that is not adequate to justify the illiquidity and risk of private market investing.

On the other side, fund managers face similar inefficiencies. They struggle to efficiently connect with the right limited partners, they often default to higher investment minimums that exclude a broad pool of potential investors and rely on outdated tools for LP reporting and communication.

What IF this wasn’t the case?

While I haven’t spoken as much publicly as I should have about what we are up to at Allocate, I have had so many people ask me what we actually do and don’t (note to self: do a better job on this).

Here are a few TLDR points:

Allocate is not a fund of funds. While I respect so many of the great FoF managers, we are solving for something different through technology.

Private market investing has the potential to mirror public investing when it comes to access, portfolio transparency, and liquidity.

Artificial intelligence and data driven models will transform the private markets.

Private market investing in not a one size fits all. Tailoring and Personalization are the key in the future.

Allocate: Modernizing the private market experience

At Allocate, we are continuing to build a lifecycle platform to bring this vision to life, with purpose-built software and data at the core.

While we started our journey by enabling responsible investing in opaque asset classes such as venture capital (and now Private Equity as well), we continue to believe that solving the private market pain points requires a focused software and data-first approach to provide the necessary tools for investors to efficiently achieve the best outcomes.

What does this mean?

For Investors:

Imagine:

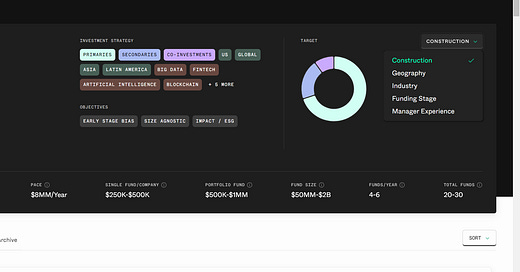

Imagine discovering and analyzing highly personalized private investment opportunities that, powered by data and augmented by AI, recommend the opportunities that best account for your current portfolio and portfolio goals.

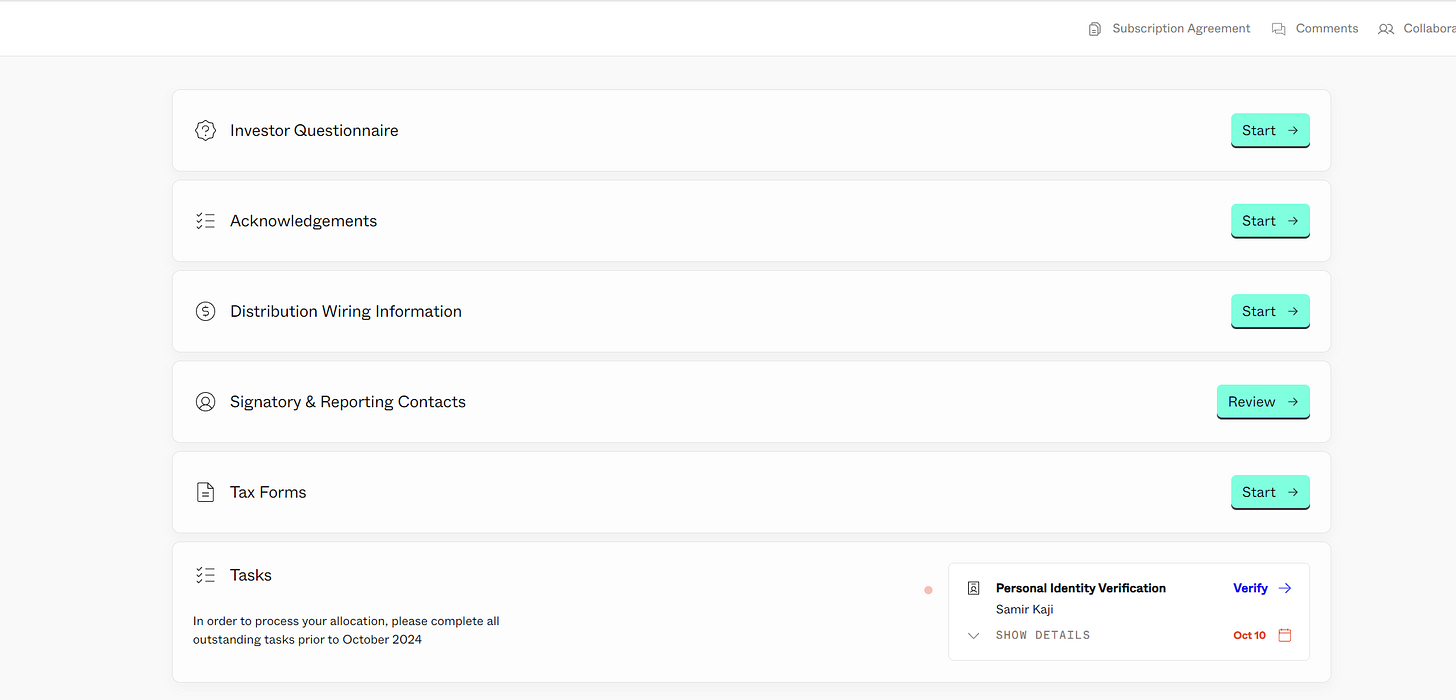

Imagine investing in private markets as seamlessly as buying a stock, with fund subscriptions and compliance done with just a few clicks.

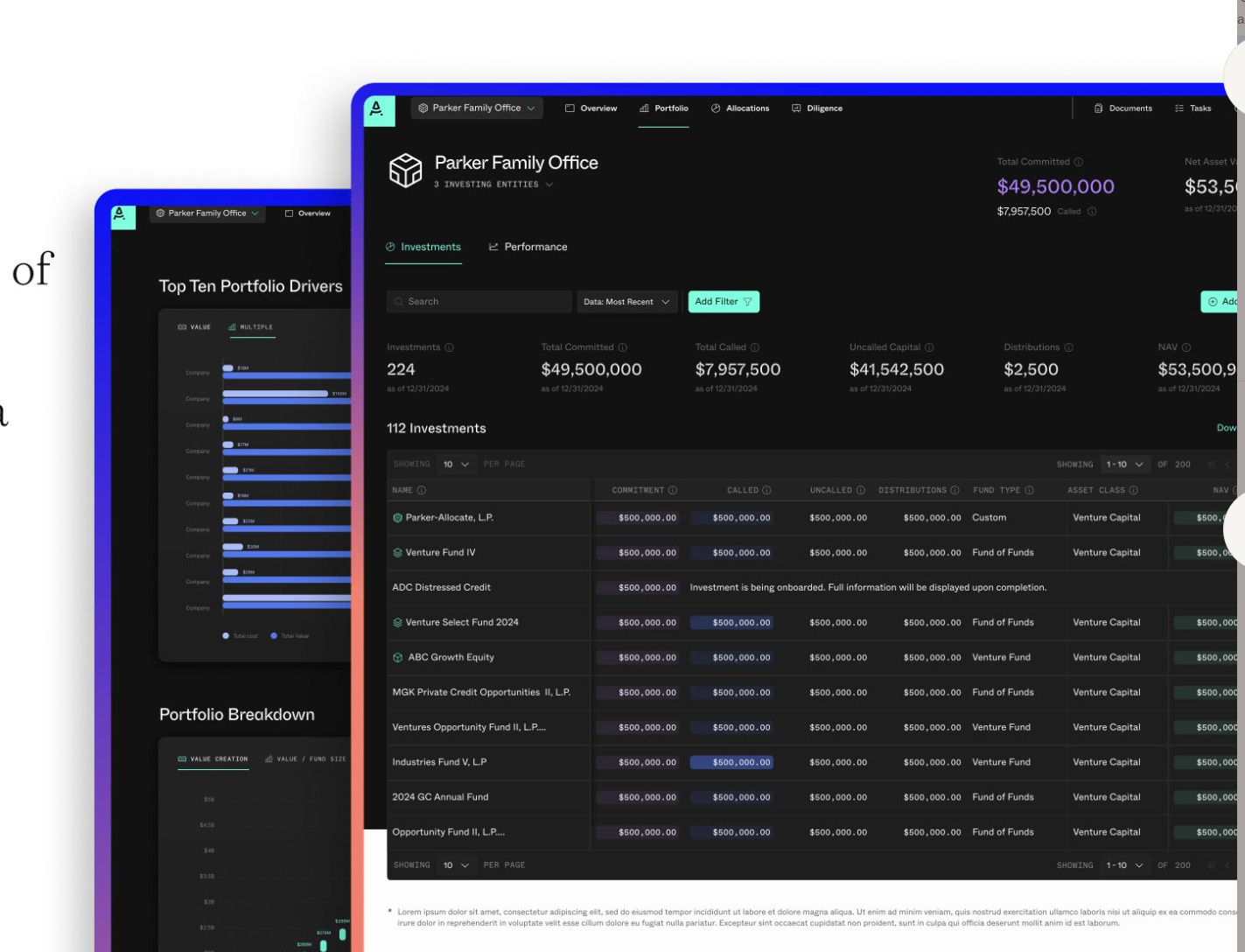

Imagine managing your entire portfolio in real time across all funds and asset classes without ever having to chase down unstructured documents. Now imagine having that data at your fingertips and simply querying your portfolio and prospective deals to gain necessary and deep real-time insights.

Imagine executing and tracking capital calls in one unified platform with one click without the hassle of managing dozens of wire instructions.

Imagine accessing liquidity through borrowing or secondaries with complete transparency and efficiency.

For Fund Managers:

Imagine:

Imagine effortlessly connecting with Limited Partners who align with your fund's goals and investment thesis.

Imagine tapping into a broader network of investors, including those traditionally excluded due to investment size, without the administrative burden of onboarding and managing these relationships.

Imagine providing your investors with state-of-the-art reporting and analytics, allowing you to build better trust and transparency (screenshots of our platform below do not represent real funds).

Imagine providing your LPs with innovative liquidity solutions, enabling you to relieve the pain of illiquidity.

Imagine leveraging an intuitive platform that automates routine processes like capital calls, transfers, reporting, and capital management, allowing you to dedicate more time to creating value for your investors.

The future of private market investing is not only more efficient but also more transparent, inclusive, and data-driven. This is the vision we are building at Allocate—creating a platform that transforms how investors and fund managers interact with private markets, making it more accessible, efficient, and intelligent through the power of data and purpose built software.

Want to learn more? Click here to get in touch with us (or email me directly at Samir@allocate.co).

I will just leave a feedback on how I felt after reading this- like a kid in a candy store!

*Imagine*: this goes global and an LP may, more easily, assess global VC funds.

Samir, The SignalRank Index should be a component offered across your platform - see here for info https://signalrank.ai. It strongly meets your narrative and criteria.